Breaking Down the Craft Beverage Modernization and Tax Reform Act

While the Tax Cuts and Jobs Act of 2017 was initially a two-year deal set to expire in 2019, the craft beverage modernization and tax reform provisions of the act were extended through Dec. 31, 2020. These new rules were a boon to producers of beer, distilled spirits , and wine across the country, but those changes are running out of time. As such, proponents of these CBMA’s changes are pushing Congress to pass the Craft Beverage Modernization and Tax Reform Act (CBMTRA).

What is the Craft Beverage Modernization and Tax Reform Act?

The short answer is that the CBMTRA would permanently modify the tax treatment of certain alcoholic beverages in accordance with the CBMA specifications found in the Tax Cuts and Jobs Act of 2017.

There are a variety of provisions included in the CBMTRA. These propositions include the move to permanently lower federal excise tax rates on alcohol to those listed in the Tax Cuts and Jobs Act of 2017. The bill also seeks to keep several other provisions that apply to beer, distilled spirits, wine, and more.

Beer

One of the main goals of the CBMTRA is the continuation reduced federal excise tax rates on any beer that is imported or removed from a brewery. The CBMTRA proposes to keep the following tax rates for breweries.

- $3.50 per barrel on the first 60,000 barrels for domestic brewers producing fewer than 2 million barrels annually (previously $7 per barrel)

- $16 per barrel on the first 6 million barrels for all other brewers and all beer importers (previously $18)

- $18 per barrel rate for barrels not subject to the $16 rate (same rate as in the past)

These rate changes mark a notable savings for domestic brewers. Another potential savings is that the CBMTRA would allow bonded facilities to transfer beer without an additional tax payment.

Distilled spirits

As with beer, the CBMTRA seeks to maintain reduced tax rates for spirits that are distilled or processed and removed. In the past, the federal excise tax was set at $13.50 per proof gallon with adjustments depending on the percentage of alcohol of the product. The new rates not only lower these rates, but also break them into different groups depending on number of barrels removed or imported.

- $2.70 per proof gallon on the first 100,000 proof gallons

- $13.34 per proof gallon on the next 22.23 million proof gallons

- $13.50 per proof gallon for anything past 22.23 million proof gallons

The CBMTRA also includes a note regarding the transfer in bond of distilled spirits between distilled spirits plants. The Act seeks to permanently allow such transfer whether or not the distilled spirits in question are transported in bulk or non-bulk containers.

Wine

Unlike beer and distilled spirits, the CBMTRA would not institute a new tax rate for wine produced domestically or imported into the country. However, the Act does allow for different tax credits depending on wine production and the tax class of the wine in question. These credits include:

- $1 per wine gallon on the first 30,000 wine gallons of wine removed or imported

- 90 cents on the next 100,000 wine gallons removed or imported

- 53.5 cents on the next 620,000 wine gallons removed or imported

The CBMTRA also adjusted the existing tax classes and expanded the categories of producers covered by such credit. Previously, wines with 14 percent or less alcohol received the lowest tax rate ($1.07 per wine gallon). Under the CBMTRA, that rate now applies to still wines with 16 percent of fewer, along with any applicable tax credit.

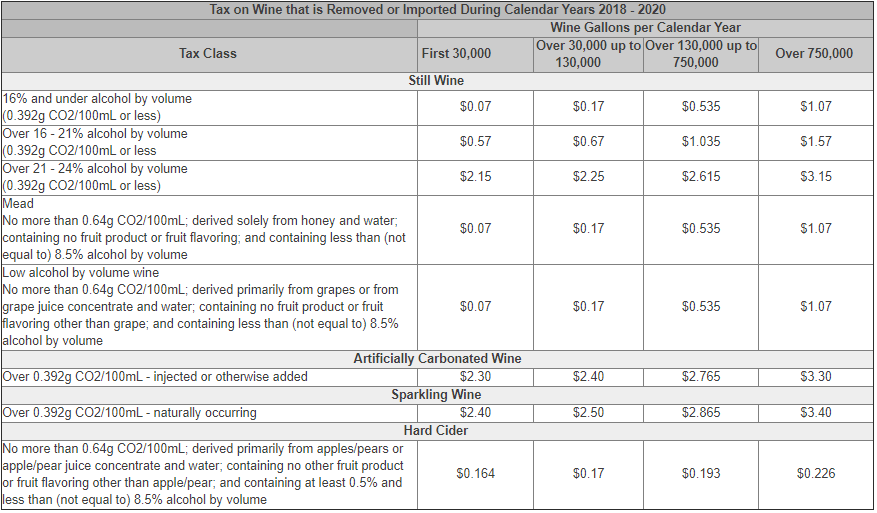

In addition, both meads and low alcohol by volume wines are considered still wines by the CMTRA. These join artificially carbonated wines, sparkling wines, and hard cider as other tax classes included under the wine tax breakdown. To make things even trickier, hard cider is the only one of these products that does not utilize the aforementioned tax credits. Instead, they have a separate adjustment to producer credits. Check out the chart below for a detailed breakdown of all the federal excise taxes on various still wines (with applicable tax credits included).

What’s Next for Craft Beverage Modernization and Tax Reform Act?

While the CBMA provisions are still in effect through the end of the year, those new tax rates will reset in 2021 without Congressional action. Several beverage alcohol trade associations have banded together to urge Congress to pass the CBMTRA in time to prevent the significant increase in federal excise tax rates, especially while the industry is still feeling the impacts caused by the COVID-19 pandemic. For those interested in joining the call to pass the CBMTRA, you can join the call here.